Turnover increase and growth: why is the P&L item, “turnover”, hardly relevant and what role does your company’s liquidity and “cash cycle” play?

In the first part, we looked at your company as a process and worked out that the duration of many activities is within a range that is significantly influenced by the human factor.

In the second part, we highlighted that customer behaviour also has a significant influence on this range. In particular, the behaviour of the “wrong” customers, whom you increasingly attract through a marketing strategy aimed at increasing turnover and growth.

Having sufficiently gone through the importance of human resources, I would now like to turn to the topic of financial resources and liquidity: specifically, debt financing and equity financing.

How important is “turnover” in an income statement?

Further to the above, I addressed the problem in connection with internal accounting and mentioned in passing that turnover is placed at the very top as the hub of the business world.

What is the relevance of “turnover” in an income statement?

As far as I am concerned, hardly any! Because turnover only represents a rather insignificant step in the process, namely the handing over of the invoice.

The “payment-receipt” step is really important and of particular relevance because this step provides the necessary liquidity.

Unless your employees and suppliers are satisfied with an IOU from you and don’t expect any real cash from you in their accounts, you will also need liquidity in the form of real cash flowing in.

This brings us to the topic of cash flow and your company’s cash cycle along the core process.

Liquidity: cash conversion cycle

One indicator that is often used for this purpose is the cash conversion cycle (CCC). It is the length of time in days that liquidity is tied up in your company’s current assets.

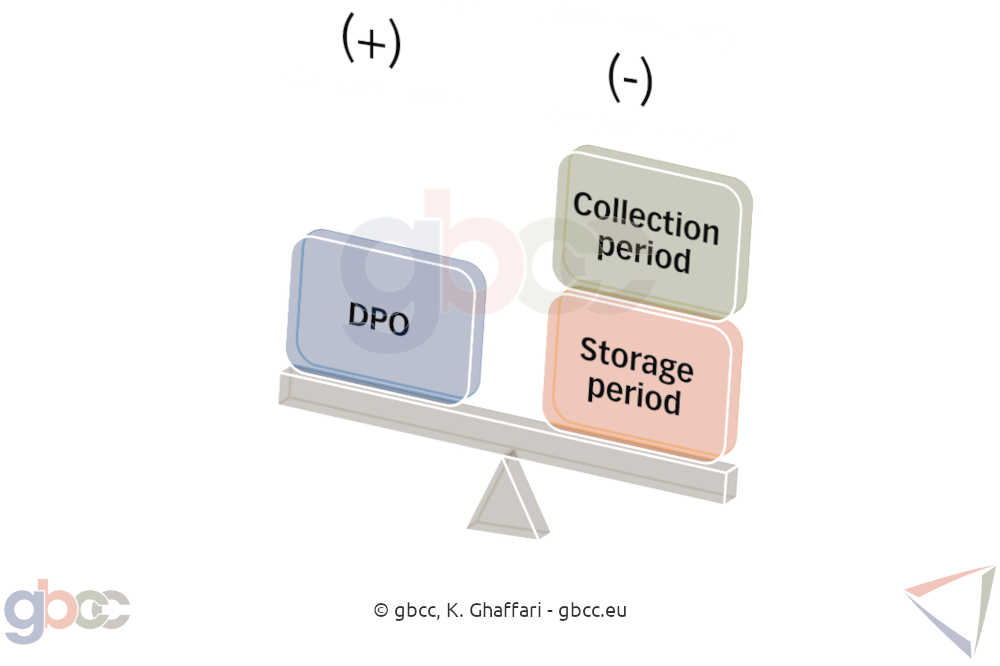

CCC is calculated as follows:

- ∅ Duration of the collection period

- Plus ∅ storage period

- Less ∅ days payable outstanding (DPO)

In other words, you have to pre-finance the period until your customer pays and you have to pre-finance the period until the purchased/produced goods that are in stock are sold. You can compensate/refinance this proportionally because you do not have to pay your suppliers’ invoices immediately.

The advantage of this formula is that it is calculated by the system and is publicly available for listed companies. With this formula, I would like to draw your attention to a very specific aspect:

Take the CCC (numbers = no. of days) of the last business year of the two competing corporations: Samsung and Apple.

Reporting date: | Samsung (31.12.18) | Apple (30.09.18) | |

|---|---|---|---|

| ∅ Collection period | 50.71 | 31.86 | |

| (+) | ∅ Storage period | 76.65 | 9.82 |

| ( – ) | ∅ DPO | 23.38 | 124.57 |

| (=) | CCC | 102.98 | – 82.89 |

We can see Samsung has to pre-finance for an average of 103 days. Whether it has to raise the liquidity for pre-financing primarily from equity or debt depends significantly on its operating cash flow.

Cash flow from operating activities

In other words, it is not the accounting view consisting of “turnover minus expenses = income” that is relevant here, but the liquidity that actually directs “cash” in minus the liquidity that directs “cash” out – “cash flow from operating activities”.

This amounted to $40 billion for Samsung, which translated to 28% of turnover! Comparatively, their P&L profit was equal to 18%.

Now, look at the CCC of their competitor, Apple, in comparison: a CCC of minus 83 days! Let that sink in!

Apple’s cash flow from operating activities was $77 billion, which translated to 29% of revenue! Comparatively, their P&L profit was equal to 22%.

In short: Apple is literally awash with money.

Apple grows steadily while investing, and yet, as of 30th September 2018, the company had put aside $66 billion in cash that was immediately available. That represents 18% of their total assets.

In such an environment, you can grow purely from internal financing and the sky is the limit. You are not dependent on banks or other external financing.

SMEs pay too little attention to liquidity

Companies in the German-speaking world in general, and particularly SMEs unfortunately, rarely pay attention to cash flow or CCC considerations or the like.

Sometimes, I find a ∅ collection period of several months. In addition, there is poor warehouse management that wastes money.

If you, as such a company, would nevertheless rely on a strong growth strategy, then it can easily happen that you find yourself with a negative operating cash flow (although in accounting terms, you may be showing a profit!).

In other words: you live and grow on credit! You depend on the bank to ensure your long-term viability through sufficient credit lines. Of course, it will be happy to do so – as long as you hold out the prospect of private and business assets as collateral.

Financial resource needs: are you already calculating or still rolling the dice?

Since SMEs do not prioritise investing money in financial software, there is usually a lack of usable tools for integrated corporate planning. A software that “looks into the future” using the actual figures and the targeted planning figures and creates useful forecasts about your financing needs for the next few years, amongst other things.

Nevertheless, this does not stop many companies from pursuing an expansion strategy. New customers are acquired, new orders are accepted, and COGS increase accordingly. However, there is not enough money to pay all the suppliers. Also, new employees are hired who want to be paid.

Ultimately, this results to your company suddenly realising in mid-gallop:

“Oops, we need more money!”

Your bank feels caught off guard, refuses to take action, or at least takes a long time to make a decision. Out of necessity, you start juggling the invoices. This is noticed by the suppliers, who become increasingly nervous.

At the same time, your increasingly unproductive and unprofitable processes are having their effect. Your profit margin leaves much to be desired. Profit retention does not grow in proportion to the balance-sheet growth.

Your equity ratio decreases as a result. The deteriorating financial ratios have a negative impact on your company’s rating. Banks and credit insurers are therefore becoming increasingly nervous and are critically questioning the maintenance of your lines in their internal committees.

We’ve come full circle to my statement at the beginning: an astonishing number of good, solid companies get into enormous difficulties, or even go bankrupt, precisely because they had previously started with a growth strategy.

Conclusion (Parts 1 to 3):

You must be able to afford a growth strategy. You can afford it if

- You establish clear processes and sufficiently take into account the “human factor”,

- The duration of your processes and costs are known to you and you are working on optimising them,

- You can – at least roughly – allocate personnel and general costs to important customers according to the cause,

- You have tools for professional financial and corporate planning and

- The liquidity to finance your growth is available.